The 10-Minute Rule for Fortitude Financial Group

Fortitude Financial Group - Truths

Table of ContentsThe Ultimate Guide To Fortitude Financial GroupThe smart Trick of Fortitude Financial Group That Nobody is Talking AboutThe 25-Second Trick For Fortitude Financial GroupThe smart Trick of Fortitude Financial Group That Nobody is Discussing

With the appropriate plan in position, your cash can go even more to assist the companies whose missions are straightened with your values. A monetary consultant can help you specify your philanthropic offering objectives and incorporate them into your monetary strategy. They can additionally advise you in proper ways to optimize your providing and tax deductions.If your business is a collaboration, you will wish to experience the succession planning process together - Financial Services in St. Petersburg, FL. A financial consultant can assist you and your companions recognize the essential components in organization sequence planning, identify the worth of the organization, develop investor arrangements, develop a payment framework for followers, overview transition choices, and far more

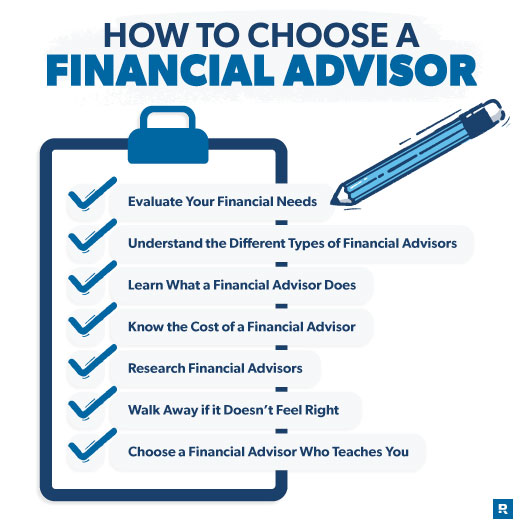

The trick is finding the best monetary advisor for your situation; you might end up interesting different advisors at different phases of your life. Attempt contacting your economic establishment for referrals.

Your next action is to consult with a certified, certified professional that can offer recommendations customized to your private scenarios. Absolutely nothing in this article, nor in any associated resources, must be taken as economic or legal suggestions. Furthermore, while we have actually made great confidence initiatives to make sure that the info provided was right since the date the material was prepared, we are unable to guarantee that it continues to be exact today.

Fortitude Financial Group Can Be Fun For Everyone

Financial advisors assist you make choices regarding what to do with your money. They direct their customers on conserving for significant acquisitions, putting cash apart for retirement, and investing cash for the future. They can additionally advise on present economic and market task. Let's take a more detailed consider exactly what an economic consultant does.

Advisors utilize their knowledge and expertise to build tailored financial strategies that intend to achieve the economic objectives of customers (https://fortitudefg1.start.page). These strategies consist of not just investments however likewise financial savings, spending plan, insurance policy, and tax techniques. Advisors further examine in with their clients on a normal basis to re-evaluate their present situation and plan as necessary

Fortitude Financial Group - An Overview

Allow's say you wish to retire in two decades or send your child to an exclusive university in one decade. To complete your objectives, you might require a knowledgeable specialist with the appropriate licenses to assist make these strategies a truth; this is where a financial expert can be found in (Financial Advisor in St. Petersburg). Together, you and your advisor will cover numerous topics, including the amount of money you must conserve, the sorts of accounts you need, the kinds of insurance coverage you must have (consisting of lasting treatment, term life, special needs, and so on), and estate and tax obligation preparation.

Financial experts supply a variety of services to customers, whether that's giving trustworthy general investment suggestions or assisting within a monetary goal like investing in an university education fund. Below, find a listing of the most typical services offered by financial advisors.: An economic advisor uses suggestions on financial investments that fit your design, objectives, and danger tolerance, developing and adjusting spending method as needed.: A monetary consultant creates strategies to aid you pay your financial obligation and prevent debt in the future.: A financial advisor offers tips and techniques to produce spending plans that aid you satisfy your objectives in the brief and the long term.: Part of a budgeting technique may consist of strategies that help you pay for higher education.: Furthermore, an economic advisor produces a saving plan crafted to your particular needs as you head right into retirement. https://us.enrollbusiness.com/BusinessProfile/6826651/Fortitude%20Financial%20Group.: An economic consultant helps you determine individuals or companies you desire to get your legacy after you pass away and produces a strategy to accomplish your wishes.: An economic consultant gives you with the very best long-lasting options and insurance coverage options that fit your budget.: When it involves taxes, a monetary expert may assist you prepare income tax return, make best use of tax reductions so you get the most out of the system, timetable tax-loss harvesting safety sales, ensure the very best use the funding gains tax rates, or strategy to minimize taxes in retired life

On the set of questions, you will likewise show future pensions and earnings resources, project retirement requires, and define any long-lasting financial responsibilities. In other words, you'll list all present and predicted investments, pensions, gifts, and incomes. The investing element of the survey touches upon more browse around here subjective topics, such as your danger tolerance and danger capability.

Some Known Details About Fortitude Financial Group

Now, you'll additionally allow your consultant recognize your investment preferences too. The initial analysis may also consist of an examination of various other monetary management subjects, such as insurance policy problems and your tax scenario. The consultant needs to be familiar with your existing estate strategy, in addition to other specialists on your preparation group, such as accountants and lawyers.